DDMonitor365

ihre Debitorenstämme im Blick

WarumDDMonitor365?

Sie verfügen über ein sehr breites Kundenportfolio. Die meisten Ihrer Kundenbeziehungen sind vorbildlich bis unauffällig. Nur bei wenigen Kunden kommt es zu Zahlungsschwierigkeiten oder gar -ausfällen. Doch gerade diese kritischen Kunden gilt es im Auge zu behalten – eine Herausforderung für Kreditmanager.

Handelt es sich im konkreten Forderungsfall lediglich um einen vorübergehenden Engpass bei Ihrem Kunden, oder ist das Säumnis ein ernstes Indiz für finanzielle Schwierigkeiten? Würden Sie da nicht gern frühzeitig Bescheid wissen?

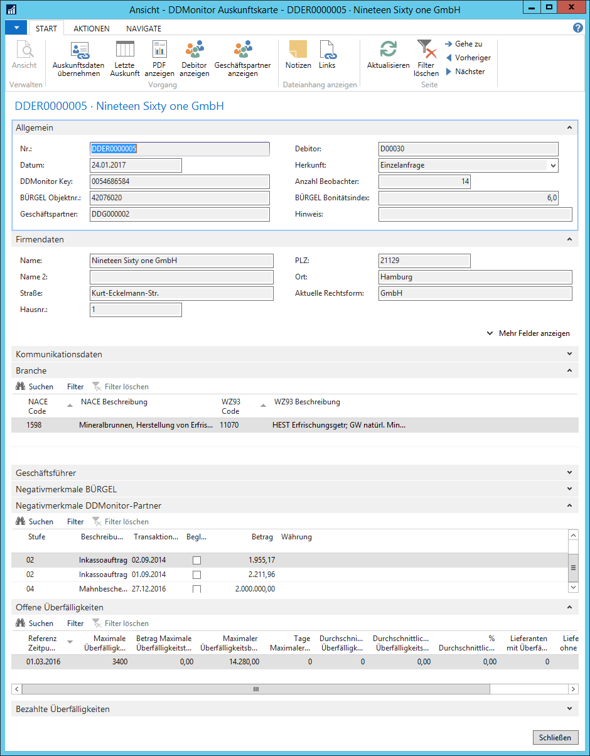

DDMonitor365 bietet Ihnen eine komfortable Anbindung an Ihr ERP-System Microsoft Dynamics 365 Business Central, die ohne viel Aufwand sehr einfach genutzt werden kann.

Was istDDMonitor365?

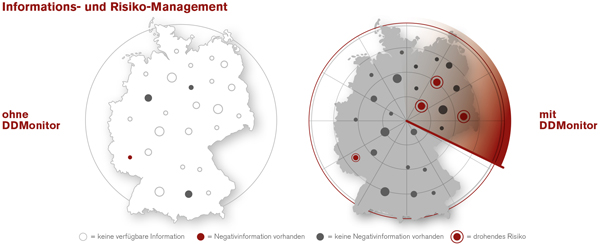

Der Deutsche Debitoren-Monitor, kurz DDMonitor, führt Informationen aus bonitätsrelevanten Datenquellen automatisiert in einer Datenbank zusammen. Durch intelligente Vernetzung entsteht die optimale Informationsbasis.

DDMonitor bietet Auskunftselemente mit Zahlungserfahrungen und Inkassodaten aller DDMonitor-Partner. Durch Quantität, Qualität und intelligente Vernetzung der Datenquellen entsteht ein umfassendes Bild über die Bonität Ihrer Kunden. Somit verfügen Sie über ein funktionierendes Radar- und Frühwarnsystem, auf das Sie Ihre operativen Entscheidungen stützen können.

Integration inMicrosoft Dynamics 365

Bessere Steuerung

fundierte Kreditentscheidung

Frühzeitig informiert

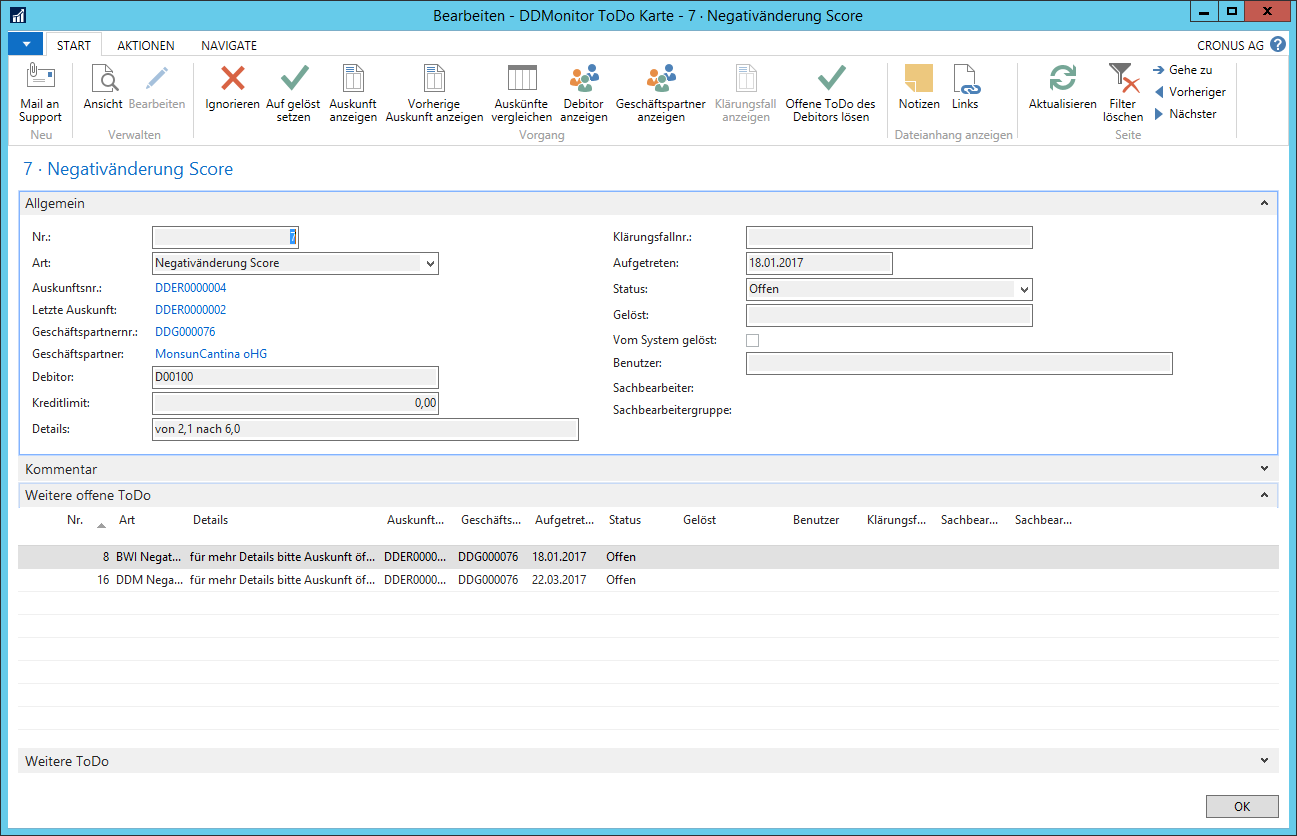

Dabei können Sie selbst entscheiden, über welche Änderungen Sie informiert werden wollen und welche Informationen für Sie irrelevant sind.

Geringere Kosten für mehr Leistung

Interessiert?Vereinbaren Sie einen Demo-Termin!

FAQ

DDMonitor365 ist die perfekte Anbindung von DDMonitor an Ihr ERP-Systen. Sie können flexibel einstellen, welche Debitoren von DDMonitor überwacht und wann Sie über welche Änderungen informiert werden sollen.